Affordable Car Insurance in Las Vegas NV

Exactly How Much Is Car Insurance in Las Vegas Nevada?

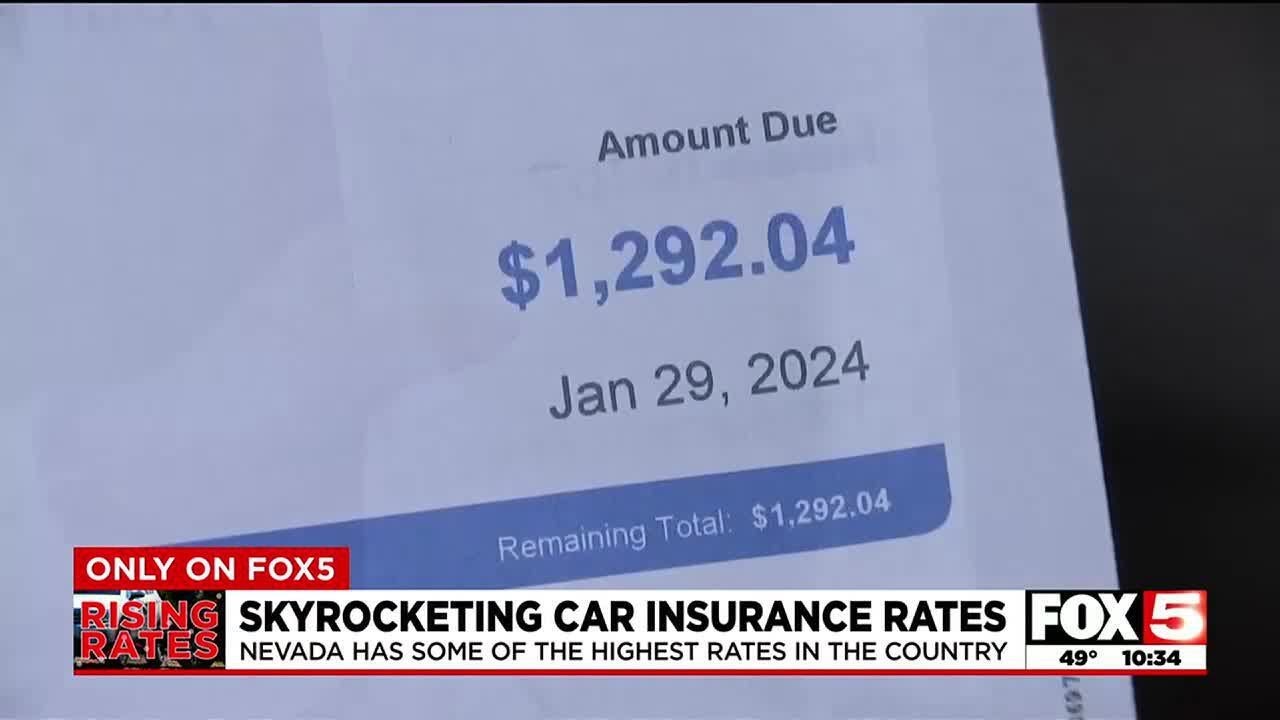

Car insurance rates in Las Vegas, Nevada differ depending upon numerous variables such as the vehicle driver's age, driving record, sort of vehicle, and preferred insurance coverage. The expense of insurance can vary from a couple of hundred bucks to over a 1000 bucks every year. Vehicle drivers have the option to choose in between different kinds of coverage, including liability insurance, comprehensive coverage, and wreck coverage, each offering varying levels of protection in case of an accident or even damage to the vehicle. It is vital for every single driver to know the minimum required insurance requirements established due to the state as well as to choose an insurance policy that finest matches their needs and budget plan. Besides car insurance, some drivers may also consider renters insurance to shield their individual items in scenario of fraud, fire, or even various other catastrophes.

Nevada Auto Insurance Rules

Nevada car insurance rules stated requirements for car drivers to hold a minimum required quantity of auto insurance coverage. This mandated minimum required consists of liability coverage to offer financial protection in case the covered by insurance gathering is found responsible in an accident resulting in property damage or bodily injury. It is essential for motorists in Nevada, featuring those in Las Vegas, to become watchful of these regulations to comply with the regulation and also shelter themselves coming from possible monetary worries if they are entailed in a fault accident. Auto insurance companies consider different aspects when finding out insurance rates, like the driver's grow older, driving history, and also the city through which they live. Individuals with a clean driving record might often get approved for lower insurance rates, specifically when guaranteeing family members, like teen car drivers, where expense financial savings could be considerable.

Property damage liability is actually an essential component of insurance coverage that decorates protection versus loss to another person's vehicle or property in an accident where the covered person is actually viewed as to blame. Nevada car insurance regulations also forbid making use of a mobile device while driving, focusing on the importance of liable and also alert driving process to reduce the probability of crashes and insurance expenses. It's advisable for motorists in Las Vegas and around the condition to frequently review their insurance as well as acquire insurance quotes to ensure they possess adequate insurance coverage as well as that they are certainly not paying out more for insurance than necessary. Providers such as Geico typically deliver discount rates for motorists that observe risk-free driving methods, additionally focusing on the usefulness of preserving a clean driving record to gain from prospective price financial savings on insurance superiors.

What Is the Ordinary Fee in Nevada for Cheap Complete Insurance Coverage Car Insurance in Las Vegas NV?

Auto insurance fees in Nevada for inexpensive complete protection can easily differ depending on several factors including driving record, coverage limits, as well as the kind of coverage options opted for. A driver with a clean driving record and higher coverage limits, featuring each bodily injury liability and also property damage liability coverage, might expect to pay additional for their auto policy contrasted to a driver with a much less thorough program.

On standard, the price of affordable car insurance for low-cost full coverage in Nevada is actually a little more than the national average. Factors such as the motorist's age, location, and also the kind of vehicle insured can easily additionally impact the general cost of auto insurance. It's important for motorists in Las Vegas NV to review quotes coming from different insurance carriers to discover the greatest prices that suit their needs while offering appropriate liability insurance protection.

Just how much Is It for Low-priced Liability Insurance or even the Minimum Required Required Car Insurance in Las Vegas Nevada?

When taking into consideration the expense of affordable liability insurance or the lowest necessary car insurance in Las Vegas, Nevada, numerous variables enter play. On standard, the monthly premium for the minimum coverage may differ based on individual conditions including grow older, driving record, and also vehicle type. While some may pick the basic lowest to satisfy lawful criteria, others might choose to buy added coverage for incorporated protection. It is crucial to take note that savings, including those forever drivers or even students, can easily aid decrease the auto insurance rate for those who qualify. Insurance representatives can give support on accessible markdowns and assist customize a plan to accommodate specific necessities.

For car drivers in Las Vegas, Nevada, the lowest necessary car insurance typically features bodily injury liability coverage that gives financial protection in the unlikely event of an accident where the insurance policy holder is actually at fault. This insurance coverage aids spend for clinical costs as well as legal fees if an individual is actually hurt. The minimum coverage per person nevada and also per accident may vary, so it is actually important to understand excess of the plan. Elements like credit scores and also gender may also impact the average rate for cheap car insurance. Female motorists, as an example, may be actually qualified for lower premiums. Giving proof of insurance is mandatory in Nevada, and also failure to sustain protection may lead to fines or also certificate revocation.

Exactly How Do Rates Review Throughout Major Cities in Nevada?

Auto insurance rates in major cities across Nevada can easily vary dramatically based upon variables such as populace quality, criminal activity fees, as well as traffic jam. When it comes to finding the cheapest car insurance companies, locals need to look at comparing quotes coming from various insurance providers to guarantee they get the absolute most affordable rates achievable. Whether you're a 35-year-old car driver or a youthful 20-year-old motorist, responsible car drivers may profit from looking for out dependable auto insurance that supplies the ideal auto insurance coverage for their needs.

Aside from the cost of auto insurance, motorists in major cities like Las Vegas ought to be conscious of condition requirements regarding continuous insurance coverage. It's critical to have digital insurance cards or even Evidence of Insurance readily accessible in the event that of unexpected emergencies. Consulting a licensed insurance agent may assist drivers navigate the complexities of motorcycle insurance as well as guarantee they are actually appropriately safeguarded when traveling.

Exist Good Car Driver Markdowns in Las Vegas NV?

Good car driver rebates are a typical incentive used by car insurance providers in Las Vegas, Nevada. These savings are actually commonly available to insurance holders along with clean driving histories as well as that have actually maintained a safe and secure driving record. Insurance provider may take into profile elements like the variety of accidents a car driver has been associated with, the coverage per accident, as well as the injury per accident when figuring out eligibility for these rebates.

Aside from safe car driver discounts, insurers in Las Vegas might likewise take into consideration other elements when working out fees, such as the form of vehicle being actually insured, teen driving laws in Nevada, and liability coverage limits. Through complying with specific criteria connected to driving behaviors and history, insurance holders may have the capacity to get approved for reduced fees and also acquire markdowns based on their danger score. It is actually wise for car drivers in Las Vegas to ask about the a variety of discount options on call to them located on their personal conditions.

What Are Actually the Necessary Car Insurance Criteria in Las Vegas NV?

In Las Vegas, Nevada, vehicle drivers are demanded to satisfy specific mandatory car insurance demands to lawfully run a vehicle while driving. Fulfilling these requirements makes sure that vehicle drivers are financially accountable in the contest of an accident. The minimum coverage requirements mandate that motorists must have liability insurance with a minimum of the minimum level of protection for bodily injury and also property damage. This administers not simply to Las Vegas however also to various other major cities in Nevada such as Boulder City and Carson City.

Eligibility requirements for car insurer in Nevada feature satisfying specific financial strength ratings to make sure that they can fulfill their commitments to insurance holders. When calculating prices, insurance providers think about a variety of elements, consisting of the make and also model of the vehicle, the car driver's grow older and also driving record, and also the coverage levels picked. Along with liability insurance, vehicle drivers in Las Vegas should likewise carry uninsured motorist and underinsured motorist coverage to safeguard themselves in the event they are actually entailed in an accident with a driver who carries out certainly not possess sufficient insurance coverage.

The Amount Of Automobile Crashes Take Place in Las Vegas Nevada?

In Las Vegas, Nevada, the frequency of auto collisions continues to be a concern for both individuals as well as auto insurers. While the application of present day security features and also anti-theft gadgets in lorries strives to reduce crashes, unforeseeable factors like sidetracked driving and adverse weather disorders remain to support the statistics. Car insurance certainly not merely works as a legal commitment yet also gives financial protection in the event of any sort of unforeseen conditions. With sample rates differing relying on aspects like age, driving past history, and the kind of coverage, motorists can discover discount opportunities like student rebates for full time pupils or motivations for making use of digital policy management tools.

In the event of a fender bender or even an extra severe wreck, possessing the ideal insurance coverage is vital. Nevada calls for motorists to bring at the very least minimal liability insurance, however alternatives like Medical Payments coverage and also additional coverages can offer enhanced protection. It is actually crucial for motorists to maintain their plans in an electronic format to avoid any sort of blunders in insurance coverage that can cause lawful consequences. Knowing the importance of bodily injury coverage as well as protecting against without insurance or underinsured motorists can deliver drivers with a sense of surveillance on the dynamic streets of Las Vegas.

The Amount Of Uninsured/Underinsured Drivers Are Actually in Las Vegas Nevada?

In Las Vegas, Nevada, the amount of without insurance or underinsured motorists when driving can easily affect the general cost of car insurance for individuals. Along with insurer factoring in the risk of coming across vehicle drivers without adequate protection, it's important for people to discover plans that offer protection against such cases. By contrasting yearly fees and finding inexpensive possibilities that supply protection for uninsured or underinsured motorists, vehicle drivers may guarantee they are actually financially guarded in the celebration of an accident.

For motorists in Las Vegas aiming to protect the most affordable prices possible, packing their plans with multi-policy markdowns may be an advantageous option. Insurance providers usually supply additional discounts to consumers who choose to mix their auto insurance along with various other plans like home or even renters insurance. By leveraging these discount rates and keeping tidy driving files, individuals may potentially decrease their yearly expenses and also superiors while still obtaining personalized quotes customized to their details needs.